Nvidia warns more chip curbs will end U.S. chipmakers’ ability

In China, Nvidia warns chipmakers that more restrictions will make it impossible for them to compete

According to Nvidia, further U.S. export curbs on its chips would risk a “permanent loss” for American semiconductor companies in one of the world’s biggest markets.

It was reported earlier this year that Washington was considering new export restrictions on artificial intelligence chips manufactured by Nvidia.

Despite the geopolitical overhang, Nvidia’s stock is up more than 220% this year and revenues are expected to nearly triple.

As a result of further U.S. export controls on its chips to China, Nvidia has warned that American semiconductor companies will lose their lead in one of the world’s biggest markets in the long run.

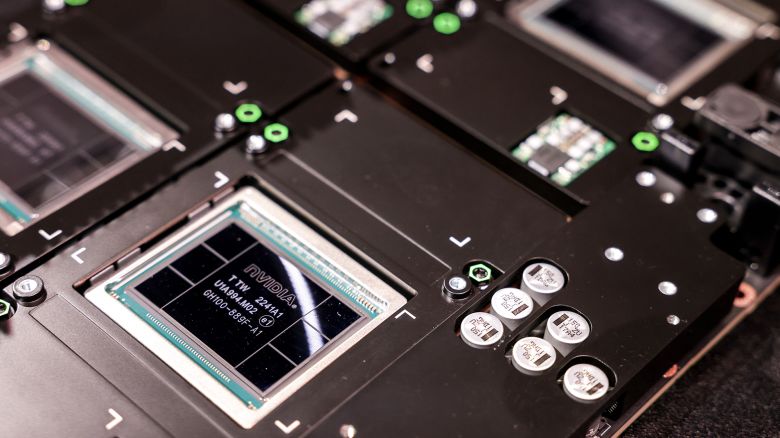

Washington was reportedly considering new export restrictions for artificial intelligence chips designed by Nvidia earlier this year. As a result, Nvidia cannot sell its top-end A100 and H100 graphics processors to Chinese customers, as the company was restricted from doing so last year.

As far as we are concerned, the current regulations are achieving the intended results. On Wednesday’s earnings call, Nvidia CFO Colette Kress said, “Given the strength of demand for our products globally, we do not anticipate that additional export restrictions on our data center GPUs would have a material impact on our financial results.”

In the long term, however, restrictions prohibiting the sale of our data center GPUs to China will result in a permanent loss of an opportunity for the U.S. industry to compete and lead in one of the largest markets on the planet.”

To comply with U.S. export controls, Nvidia introduced A800 and H800 chips, which are modified and slowed down hardware.

This comment highlights the chipmaker’s opposition to further restrictions in one of its most important markets. During the June quarter, Nvidia’s biggest unit, its data center business, grew 171% year-over-year to a record $10.32 billion in revenue. It accounts for 20 to 25% of the company’s revenue.

Semiconductors have been caught in the middle of a technology battle between the two superpowers for the last few years.

Nvidia’s chips – which go into data centers and facilitate the training of large AI models like those underpinning ChatGPT – are generally seen as being superior to those of its competitors. These chips are also used by Chinese companies that train large data sets.