UK microchip giant Arm files to sell shares in US

British microchip designing giant Arm has announced it has filed paperwork to sell its shares in the US.

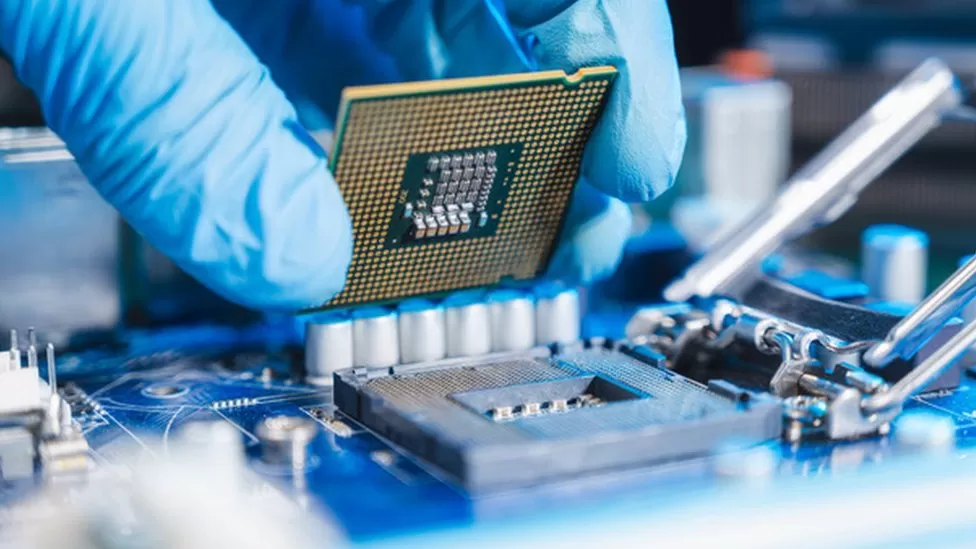

A Cambridge-based company that designs chips for smartphones and game consoles plans to list on Nasdaq in September.

Its proposed initial public offering (IPO) could be the biggest this year, though Arm did not reveal the number or price of shares for sale.

It decided not to list shares in London in March, a blow to the UK.

An IPO registration statement was publicly filed by Arm on Monday. Shares will be offered in a range of prices and the number of shares will not be determined until then.

According to reports, the company is seeking a valuation of $60 billion (£47 billion) to $70 billion.

An agreement worth £23.4 billion was signed between Arm and the Japanese conglomerate Softbank in 2016. In the 18 years preceding the takeover, the company was listed in both London and New York.

Taiwan Semiconductor Manufacturing Company and Apple and Samsung use its chip design instructions and technology to make their own chips.

Stock exchanges allow investors to buy and sell shares of a firm’s stock, transforming it from a private firm to a public company.

Earlier reports suggested the company planned to raise between $8bn and $10bn by listing on Nasdaq. As well as Google, Apple, and Facebook, other major technology companies trade on the Nasdaq.

What is an IPO?

The process of listing on a stock exchange is a way for private companies to raise cash.

Shares are offered to investors before a company lists on the stock exchange.

Share prices are usually set by investment banks hired by companies to handle the process.

The price of shares is determined by supply and demand once they become publicly traded. The market value of a company is determined by multiplying the value of its shares by how many there are.

A leading technology company in the UK, Arm was founded in 1990.

The London Stock Exchange was reported to be considering listing Arm’s owner in January, according to reports.

It stated that the US was the “best path forward” and did not plan to pursue a UK listing.

According to the decision, the UK market isn’t attracting enough tech company stock offerings, with US exchanges offering a higher profile and valuation.

However, Arm’s chief executive Rene Haas said the company would maintain its UK headquarters and operations.

In spite of the challenging global financial climate, Softbank is continuing to pursue the multi-billion dollar sale.

Since Russia’s invasion of Ukraine, stock market listings have fallen sharply. The Covid pandemic has also affected major technology companies’ shares.

The chip-making industry has faced reduced demand due to a shortage of semiconductors during the pandemic.

A slump in global smartphone shipments hurt Arm’s sales in the year ended 31 March to $2.68 billion. To $675 million, sales fell 2.5% for the three months ended 30 June.