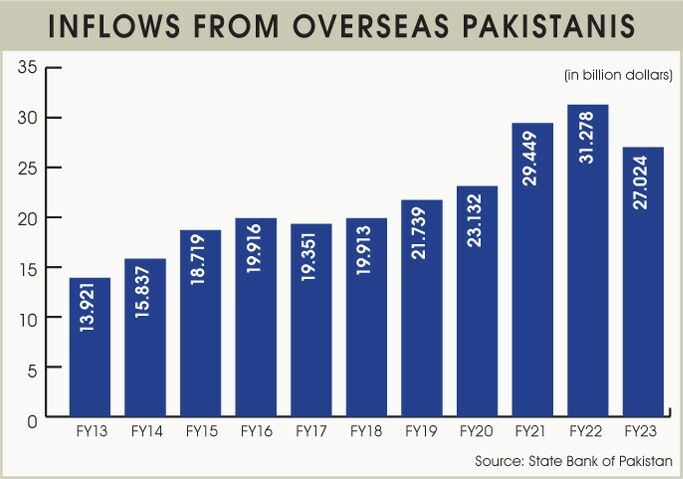

Remittances contract 14pc to little over $27bn in FY23

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Pakistan lost over $4 billion in remittances from overseas Pakistan in FY23, more than the amount the PMLN-led coalition struggled to secure from the International Monetary Fund (IMF) last year.

State Bank of Pakistan (SBP) data published on Monday showed remittances increased by 4 percent month-on-month to $2.183 billion in June, compared with $2.8 billion in June 2022.

FY23 saw remittances total $27.024bn, a decline of 13.6 or $4.254bn from FY22, a record $31.278bn.

Analysts said the government’s efforts to keep the dollar lower than actual rates hit inflows through banking channels, even though the central bank did not offer any explanation.

There was a loss of over $4 billion due to uncertainty in politics, economics, and the rate cap

The government tried to maintain the dollar-rupee parity at Rs220 in the first half of FY23, which proved counterproductive and the dollar grossly appreciated in the open market. As a result, a grey or black market emerged offering higher rates of Rs20 to Rs25 per dollar, which had a bad impact on remittances.

On Feb 26, however, the government uncapped the exchange rate under IMF pressure, causing the dollar to jump to Rs269 immediately. During the subsequent months, the greenback reached Rs299 in the interbank market on May 11, but mostly stayed in the range of Rs280-290.

“The country remained under severe political and economic uncertainty throughout FY23, which practically weakened the economy and the currency” said Atif Ahmed, a currency dealer on the interbank market.

Samiullah Tariq, head of research and development at Pakistan Kuwait Investment Company (Private) Limited, said that high interest rates in the international market have also provided an opportunity for remitters to earn higher returns.

Saudi Arabia accounted for the largest inflow, but it fell by 16.9pc to $6.445bn in FY23. As a percentage, UAE remittances decreased by 20.5pc to $4.468bn.

There was a decline in remittances from all major destinations, with the exception of the US, which increased by 0.1pc to $3.090bn in FY23. Inflows from the United Kingdom fell 9.7 percent to $4.056 billion.

Inflows from the GCC and EU countries fell by 12 percent and 7 percent, respectively, to $3.191 billion and $3.12 billion.