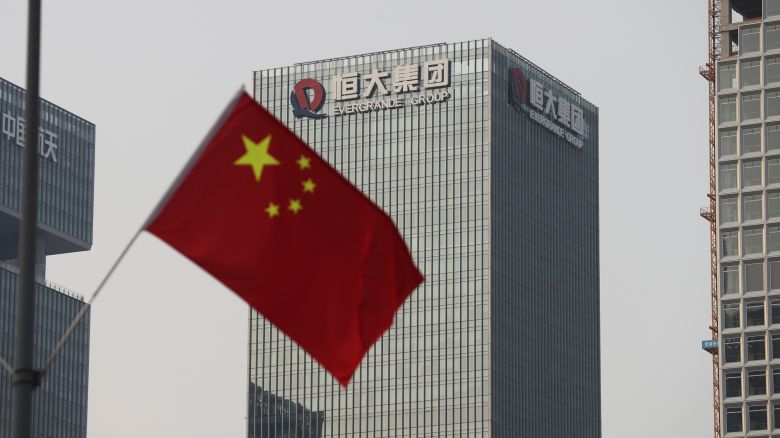

China’s largest property developer Evergrande files for bankruptcy

The Evergrande Group filed for bankruptcy in New York on Thursday after once ranking second in the country in terms of property development.

China’s economy continues to feel the effects of the beleaguered firm’s default in 2021, which sparked an enormous property crisis.

Evergrande filed for Chapter 15 bankruptcy protection, which allows US bankruptcy courts to intervene when foreign debtors file for bankruptcy. In cross-border bankruptcy proceedings, Chapter 15 bankruptcy aims to promote cooperation between US courts, debtors, and other countries’ courts.

In the world’s second-largest economy, the real estate sector contributes up to 30% of GDP, making it a vital growth engine. However, Evergrande’s default in 2021 sent shockwaves through China’s property markets, affecting homeowners and the country’s financial system.

Attempts to curb soaring housing prices led Beijing to crack down on excessive borrowing by developers.

In the aftermath of Evergrande’s collapse, several other major Chinese developers have defaulted on their debts, including Kasia, Fantasia, and Shimao Group. A Chinese real estate giant, Country Garden, recently warned it would “consider adopting various debt management measures” – fueling speculation that it may be preparing to restructure its debt.

Due to the country’s overall economic slowdown, the industry’s problems have been exacerbated.

According to its website, Evergrande has more than 1,300 real estate projects in more than 280 cities. As well as real estate, the company operates an electric vehicle business, a health care business, and a theme park.

After defaulting on its debt in late-2021, Evergrande has been struggling to repay its loans. A 2.437 trillion yuan ($340 billion) debt load was accumulated by the company by the end of last year. The amount represents roughly 2% of China’s entire GDP.

Furthermore, Evergrande reported last month that it had lost $81 billion in shareholder money in 2021 and 2022.