Bitcoin is up 12% this month — even though barely anybody is trading it

Bitcoin is up 12% this month — even though barely anybody is trading it

POINTS TO NOTE

-

Since the beginning of June, Bitcoin’s price has risen by more than 12%.

-

The jump was attributed to news that BlackRock had filed for a spot bitcoin exchange-traded fund.

-

Since liquidity remains low, large purchases by so-called bitcoin whales are more likely to move bitcoin.

-

Cryptocurrency prices are fluctuating dramatically as a result, according to analysts.

Despite what you might think, Bitcoin rallied sharply this month.

Over 12% has been added to the value of the world’s largest digital currency since the beginning of June. According to Coin Metrics, its price topped $30,000 on Wednesday.

The jump has been attributed to news that U.S. asset management giant BlackRock had filed for a spot bitcoin exchange-traded fund tracking the market price.

This may account for part of the outsized move, but there is another factor beyond large institutions embracing bitcoin or other digital assets that can account for it.

Big players and thin liquidity

The “market depth” of crypto has been very low this year. An indicator of market depth is how well a market can absorb relatively large buy and sell orders. If market depth is low and big players put in orders to buy or sell digital coins, prices can move in a big way, even if the orders are not large.

A market’s depth is a measure of its liquidity.

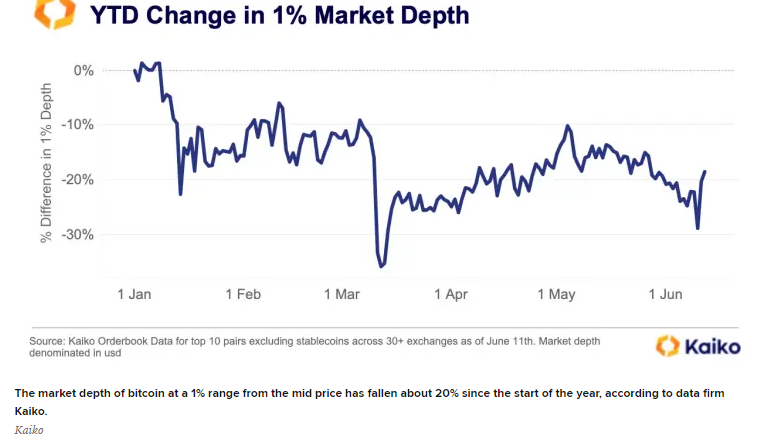

Bitcoin’s market depth has declined 20% since this year’s start, according to data firm Kaiko. Kaiko said bitcoin is one of the cryptocurrencies with the lowest market depth.

According to Jamie Sly, head of research at CCData, bitcoin’s recent surge has largely been driven by large trades within a less liquid market.

In our analysis of market orders over 5 BTC, we find a surge in aggressive market buying, suggesting that large players are investing in digital assets in order to gain exposure to them.”

As a result of large orders combined with thin books, the market becomes more volatile.

Regulatory scrutiny of the crypto industry by U.S. authorities has contributed to a lack of liquidity. In addition to Coinbase and Binance, the Securities and Exchange Commission has sued other major exchanges.

In addition to low liquidity, bitcoin’s 80% rally year-to-date can also be attributed to low liquidity.

As of yet, retail traders have not returned

Traders on crypto exchanges are also experiencing low volumes in the current market.

Currently, CoinGecko reports that the daily volume of cryptocurrency trading is $24 billion.