There seems to be no end to the path that leads deeper and deeper into loans

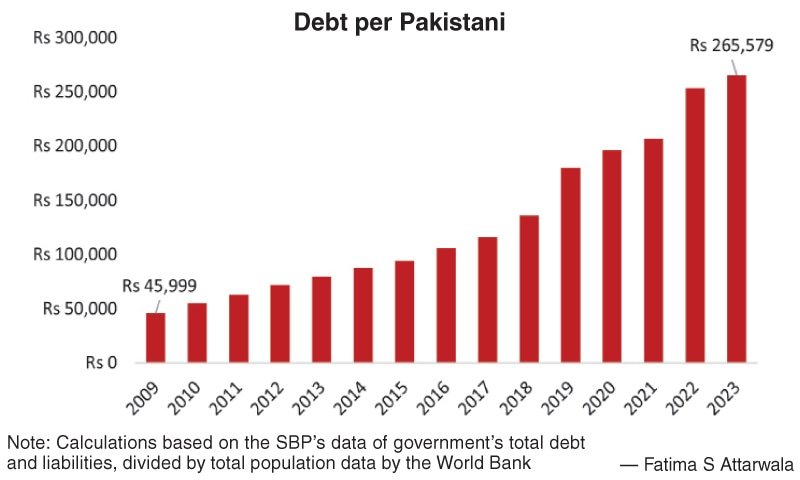

In a sense, every baby born in Pakistan owes more than Rs200,000.

Pakistan’s debt per person is calculated by dividing its total debt and liabilities by its total population. IMF loans have been a constant source of income since 1958.

Taking funds from domestic banks leaves the industry high and dry. Lack of credit restricts industries’ expansion, investment, and job creation. Lack of credit availability affects the people directly, impacting their livelihoods.

These loans consume a large portion of the government’s budget in interest payments. Trying to fill a leaking bucket is like trying to fill a leaky bucket. Education, healthcare, and infrastructure are among the sectors in need of investment, but the government keeps pouring money into paying off the debt.

There are a lot of sectors in Pakistan that do not pay their share of taxes because of the vast informal economy. For example, the heavily taxed usually pay more taxes when deficits need to be bridged or if the Fund needs to be pacified.

Consumption-driven growth is the main cause of the country’s perpetual current account deficit. Spending is a big part of Pakistani culture. Despite rising imports, exports have been struggling.

There seems to be no end to the path that leads deeper and deeper into debt. Due to this, the children of the babies born today will probably be saddled with even greater debt.