Shares surge by 570 points on Saudi inflow, expected IMF tranche

Experts attribute the increase to the $2 billion Saudi Arabia deposited with the State Bank of Pakistan today, as well as the anticipation of funds from the International Monetary Fund (IMF).

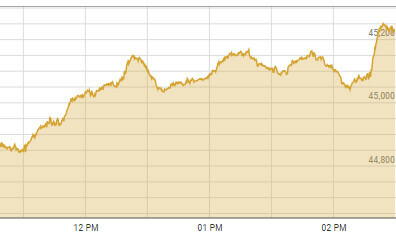

By the end of the day, the benchmark KSE-100 had gained 570.67 points, or 1.28 per cent, to reach 45,155.79 points.

The Saudi Arabian Central Bank announced earlier in the day that it had received $2 billion from the SBP.

As a result of this inflow, SBP’s forex reserves have increased and will be reflected in the forex reserves for the week ending July 14, 2023,” Dar said.

This financial assistance will replenish the central bank’s depleting foreign exchange reserves, which had fallen to barely cover a month’s worth of controlled imports.

Pakistan’s long-term foreign currency issuer default rating was upgraded yesterday to ‘CCC’ from ‘CCC-‘ by global rating agency Fitch, following the staff-level agreement with the IMF in June on a nine-month Stand-by Arrangement (SBA).

On July 3, the benchmark KSE-100 index rose more than 2,400 points following the announcement by the IMF on June 30.

Ahead of the IMF’s board meeting on July 12, Salman Naqvi, head of research at Aba Ali Habib Securities, said, “Market crossed 45,000 points for the first time in many days.”

In his statement, he emphasized the positive developments, noting that Fitch has improved Pakistan’s rating, reducing its default risk. A total of $2 billion has been deposited by Saudi Arabia, and $1 billion is expected to be provided by the UAE.

Additionally, Naqvi said that bilateral and multilateral donors were expected to assist Pakistan, triggering a positive market reaction.

In addition, he brought to light the plummeting prices of steel and the declining international coal prices.

The lifting of import restrictions also boosted the auto industry, Naqvi said.

First National Equity CEO Ali Malik said the market has remained bullish following the government’s IMF deal.

The IMF has formally approved the $2 billion loan, which will certainly reassure investors following today’s receipt of $2 billion from Saudi Arabia.

Markets could reach 60,000 points if the situation remains stable and elections are held on time, Malik said.

The Saudi inflow of $2 billion fueled today’s rally, according to Alpha Beta Core CEO Khurram Shehzad. He expressed hope that the anticipated $1 billion inflow from the UAE would also be realized soon.

“Despite short-term fluctuations, the rupee has room to improve despite improving external account stability.”

The IMF gave Pakistan a much-needed $3bn short-term financial package on June 30, giving the economy a respite from default.

It came after an eight-month delay and offered breathing space to Pakistan, which is experiencing an acute balance of payments crisis and declining foreign exchange reserves.

Islamabad expected to receive $2.5bn from a $6.5bn bailout package that expired on June 30, but received $3bn instead, spread over nine months.